Reward Finance Group, the Leeds and Manchester-based alternative finance provider, has posted another record set of year-end figures, as it continues to expand in both Leeds and Manchester.

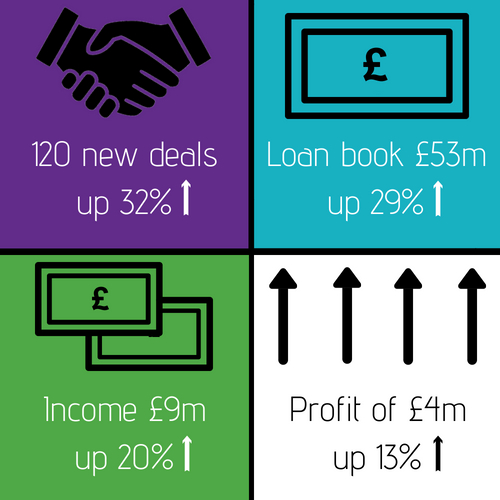

During the course of the year ending February the company delivered over 120 new deals, an increase of 32% over the previous year.

Year-end loan book increased by 29 percent to £53m, which provided fee and interest income of £9m, up from £7.5m the previous year. Profit before tax hit £4m in what is only Reward’s sixth full year of operation.

In addition, following demand from clients and introducers, Reward increased its maximum loan term to two years which has been facilitated through an additional £40m cash injection, by Foresight Group, during the course of the year.

The impressive growth was facilitated by the opening of a new Manchester office and the recruitment of nine experienced people across both offices, which has almost doubled the team.

Commenting on the results Tom Flannery, Joint Managing Director of Reward Finance, said,

“Reward was at the forefront of the alternative finance market and from the start we have always looked for a point of differentiation from other lenders. Quick decision making and certainty of delivery, on short term lending, were two things that had all but disappeared for SME’s. Over the years we have expanded our product range to ensure we can meet all the cash flow requirements of businesses and by ensuring the client has the funds when they need them.

“To be able to do this it was essential to build a knowledgeable and empathetic team to adopt a common sense approach and build long lasting relationships through responsible lending.”

Looking to the year ahead Nick Smith, Group Sales and Marketing Director of Reward Finance, said,

“It was an excellent year all round and we are keen to build on our continued success by attracting even more experienced and well connected funders to the team. We will also be concentrating on establishing ourselves as a key player in the North West.

“Consistency, transparency and the ability to understand a client’s borrowing needs, to develop a bespoke solution around them, are the values that underpin the Reward model”.